Transcription

Hello, how’s it guys? So welcome to our deep dive into hedge funds, one of the most exciting and maybe from the outside complex parts, of the investment universe. That’s due to some secrecy around it.

But today and in this series of videos, we’re gonna really deep dive and hopefully you’re gonna understand a lot more, especially for those of you that operate outside of the hedge fund industry in terms of what goes on inside these funds, how they’re structured, their strategies, et cetera.

So in this series, we’re gonna explore how hedge funds work, why they matter and how they’re different actually from traditional investment vehicles. So whether you’re aiming to just improve some of your conceptual clarity around the notes, or actually trying to get a hands-on feeling, we are gonna do both of those things in these videos to really give you a broader understanding of what’s covered in the notes, but also a practical understanding of how these things operate in the real world.

So let’s jump in.

[00:01:06] Slide 2 – Citadel

Okay, so let’s make this real and look at a couple of examples. The first one I’ve got up here is Citadel. That name should be or maybe familiar to a lot of you. It was founded by a man named Ken Griffin in 1990 and is one of the most powerful hedge funds in existence today. With about $65 billion in assets under management.

Citadel operates what is known as a multi-strategy model, which means that it trades really across asset categories, equities, bonds, commodities, credit as well as quantitative strategies. Griffin actually started by trading convertible bonds in his Harvard dorm room. And obviously that has grown in scale pretty drastically.

And today, Citadel runs one of the largest market making operations globally through Citadel Securities. So Citadel, they’re known as aggressive and incredibly sophisticated. And that’s just an overview of one of the hedge funds out there.

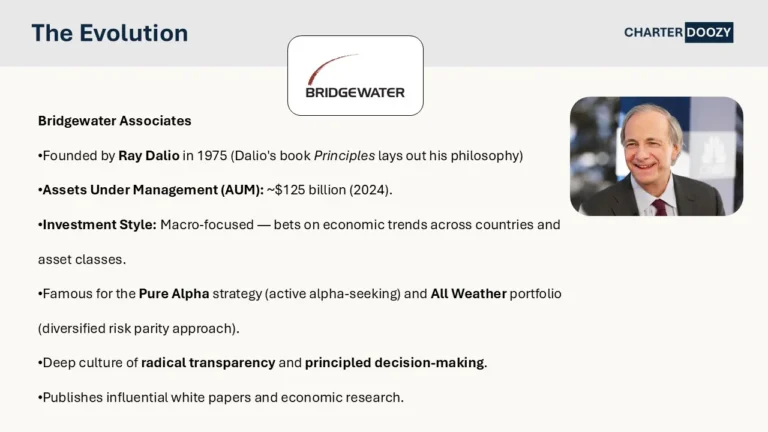

[00:02:13] Slide 3 – Bridgewater Associates

A second hedge fund, Bridgewater Associates, you may have heard of it. Alternatively, you may have heard of its founder, Ray Dalio, who’s quite a personality and well known in the investment industry. Ray started Brightwater Associates in 1975.

And again, it’s another Titan in the hedge fund industry managing around 125, billion dollars in assets under management currently. Bridgewater is what’s known as macro focused, so they bet on big picture economic trends across countries and across asset classes. They’re famous, strategies include what they call pure alpha, which is actually going out and actively seeking any opportunity that they believe will bring alpha or outperformance into the fund, as well as their all weather portfolio, which is designed for diversification across economic environments. Brightwater is also famous for its internal culture. If anyone has read the book ‘Principles’ by Ray Dalio.

He actually highlights in quite a lot of detail what goes on in that business culture. Things like radical transparency, decision making based on clear principles and a flat structure rather than hierarchical decision making. So another very different to Citadel, but another very successful hedge fund.

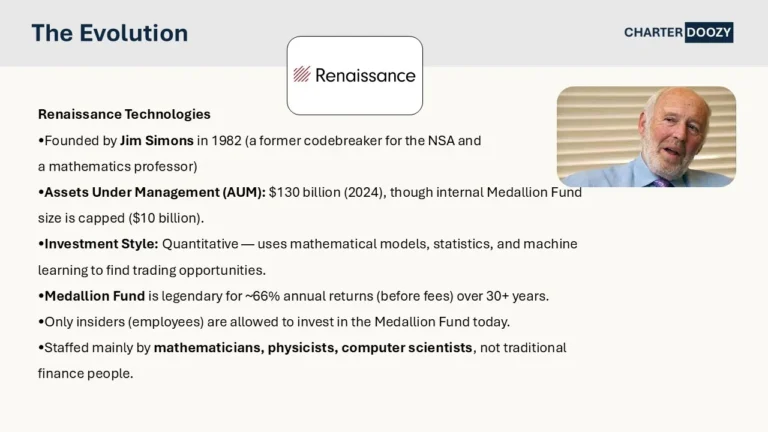

[00:03:43] Slide 4 – Renaissance Technologies

Okay. And the third hedge fund I want to highlight today is known as Renaissance Technologies, if you’ve ever heard of that name again, very, very famous, founded by a man named Jim Simons in 1982, and this fund is legendary in finance. Renaissance is pure quant, so pure quantitative, driven by maths statistics, algorithms, and not by traditional fundamental analysis.

Their secretive medallion fund, that’s their flagship fund, it’s delivered 66% annualized returns, that is before fees, over more than 30 years. So that’s a really, really staggering record- probably one for the Guinness Book, I’m sure. Fun fact Medallion is actually now closed to outside investors and the only money inside that medallion fund belongs to Renaissance employees, themselves.

So they just manage their own funds. A couple of years back, they actually returned all investors money to them and transitioned to just purely investing, for themselves. Renaissance is staffed almost entirely by scientists, mathematicians, PhDs, coders, so not a typical Wall Street types. And so I’ve already given you now kind of three profiles just to put it out there.

There are obviously many, many thousands of hedge funds out there, but you can see each with its own personality, its own approach, its own style, and each one will be judged based on its performance and its track record over a period of time.

[00:05:26] Slide 5 – What are Hedge Funds?

Okay, so now that we’ve given you a bit of a profile, what exactly is a hedge fund? So at its core, it’s a private investment vehicle with one goal. And that is absolute returns. And so what that means is, irrespective of what the market’s doing, hedge funds or the investors in hedge funds are going to look for a return year after year after year, irrespective of what happens in the market.

So hedge funds are not constrained by traditional benchmarks. They’re nimble, they’re opportunistic, and often they’re secretive in terms of how they go about generating that alpha. Access to these funds is restricted often but the strategies, like I said, are wide open more so than some of the traditional investment vehicles out there.

[00:06:14] Slide 6 – Key Characteristics of Hedge Funds

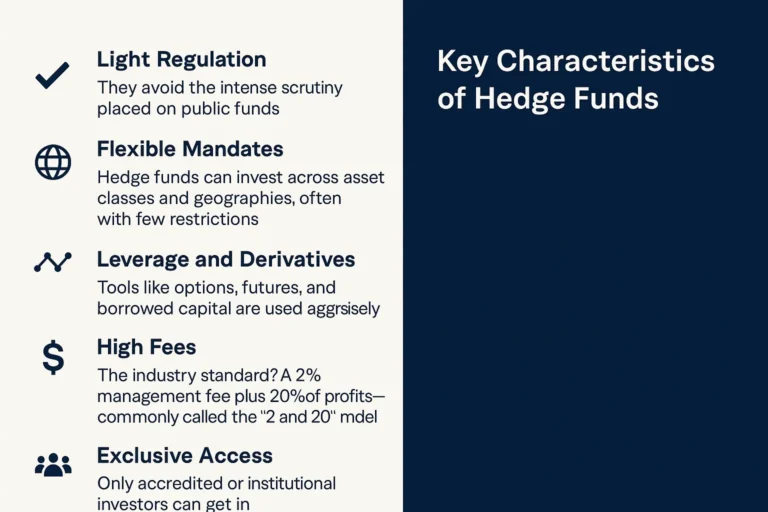

Okay, let’s break down what makes hedge funds unique? So, one, they are lightly regulated, which means they have more flexibility in terms of the strategies that they can pursue. What this also means is more risk. Typically because of that lighter regulation.

They’re actively managed with customized strategy.

They often use leverage and derivatives, so there’s quite a lot of flexibility in terms of the strategies they can employ and the leverage, they could put behind those positions, which they take.

There for sophisticated investors only. So retail investors typically are excluded from accessing these funds.

In terms of fees, we’re gonna jump into it in some of the later videos, but they’re quite well known for what’s known as the 2 and 20 fee. So that’s typically a 2% management fee. So 2% of assets under management, as well as 20% of profits that get generated, again, as a performance fee. It’s steep, but again, investors really paying in these funds for Alpha, for that out performance.

[00:07:27] Slide 7 – What’s in a Name?

The name Hedge Fund comes from the original long short equity strategy that these funds originally pursued, and that was really aimed to neutralize market risk. So what these funds did is they took in the stock market long positions on certain stocks, short positions on other stocks. As a blended basket, or on a portfolio view, they try to be beta neutral and market neutral. That means, if markets went up or down, if there was volatility in the market, they would typically be hedged against that, hence the word hedge fund. But where they would make their money then is from the relative positions of where they went long and those positions going up relative to the positions that they bet bit short on going down.

There are still funds that pursue a long, short strategy, but typically they’ve moved away from that tight definition.

[00:08:25] Slide 8 – Hedge Funds vs Traditional Funds

Okay, to this home now let’s look at some of the key differences between hedge funds and mutual funds or ETFs to really highlight and contrast the differences. So traditional funds, they would typically track indexes and diversify market risk.

Hedge funds aim to outperform regardless of the market. They do this through strategic, sometimes contrarian bets often with higher risk and higher returns.

[00:08:56] Slide 9 – Why do Hedge Funds Matter?

Alright, like we said, hedge funds offer potential access to this elusive alpha, which you’re gonna hear a lot through the hedge fund section. They have a lower correlation with traditional asset classes, or at least that’s the theory, which, if true, provides quite a powerful diversification tool for a portfolio manager.

So that’s why institutions love them. But they’re not for everyone, and performance is not guaranteed.

[00:09:30] Slide 10 – Who Invests in Hedge Funds?

Okay. You won’t find average retail investors here. Hedge funds are typically the playground of pension funds, endowments, sovereign wealth funds, high net worth individuals and family offices. And in fact, there’s often regulation which excludes retail investors from these funds. So these are for investors that can understand the complexity and also can afford to take the swings and the risks that are involved in investing in these hedge funds.

[00:10:05] Slide 11 – Common Hedge Funds Strategies

Originally, like we said, hedge funds focused on equity, long short positions to hedge against market direction. Today that has changed and there are a broad range of different, strategies.

So some of them would include event driven strategies, global macro strategies, convertible arbitrage strategies, relative value, multi strategies. There’s a range of them. We’re gonna look at each of them specifically in later video.

But these approaches, what they all have in common is that they seek absolute returns. So again, we’ll unpack these fully in the next, couple of videos. So don’t stress too much, but just get familiar with these names because you’re gonna be seeing them, quite a bit more as we go along.

[00:10:53] Slide 12 – The History of Hedge Funds

And now a bit of a history lesson. The hedge fund industry began in the 1950s with a gent named Alfred Winslow Jones. Looks like a party animal to me. In any event, the concept took off and really then exploded in the 1990s and the two thousands, especially after it became more accepted for institutions to allocate a percentage of their portfolio to this asset class. Today, hedge funds manage over $4 trillion in capital globally, and new funds are being opened as well as closed all the time.

[00:11:33] Slide 13 – Key Takeaways

Okay, we’ve raced through this, but really the idea of this video, just to introduce some of the pieces that we’re gonna be covering in more depth in later videos. So just to wrap it up, hedge funds, they’re private, they’re powerful, and they are complex in terms of what they do and how they’re structured.

They chase alpha, they’re bold and often have unconventional investment strategies. They’re exclusive, they’re expensive, and they are high risk and high reward.

[00:12:05] Slide 14 – Practice Question 1

Finally, as always, a couple of quick questions just to make sure you’ve, stayed awake through this video. Feel free, press pause if you need a bit of time to read, or think about it. But let’s get started.

What distinguishes hedge funds from mutual funds?

[00:12:22] Slide 15 – Answer 1

C is your answer here. Hedge funds use flexible strategies and high leverage.

[00:12:32] Slide 16 – Question 2

Okay. Which of the following is not a defining characteristic of hedge funds?

[00:12:37] Slide 17 – Answer 2

B, daily liquidity and high transparency. These are illiquid and typically quite secretive in terms of their strategies and their positions.

[00:12:50] Slide 18 – Question 3

Which investor is the least likely to invest in hedge funds?

[00:12:57] Slide 19 – Answer 3

And of course it’s B the retail investor, these funds are typically the domain of sophisticated, or higher net worth institutions or individuals.

[00:13:09] Slide 20 – Question 4

What was the original purpose of a hedge fund?

[00:13:14] Slide 21 – Answer 4

And the answer here is c. To neutralize market exposure via long, short positions.

[00:13:24] Slide 22 – Up Next… Hedge Fund Investment Deatures

Okay. Now that you know the basics of what a hedge fund is and where they come from, it’s now time to explore how they operate.

So, in the next videos, we’ll deep dive into hedge fund structures, how their fees work, how relationships between managers and investors are built, as well as the strategies that they employ.

So get ready to look under the hood of the hedge fund engine, and I’ll see you in the next videos.

Hedge Funds: The Wild Frontier of Investing

They go by names like Citadel, Bridgewater, and Renaissance Technologies—some of the most secretive and successful financial institutions in the world. They manage hundreds of billions of dollars. They recruit PhDs, ex-intelligence officers, and mathematical geniuses. And they don’t play by the same rules as the rest of the investing world.

Welcome to the world of hedge funds.

Whether you’re just beginning your CFA journey or already well-versed in traditional asset classes, understanding hedge funds is essential. These vehicles are not your average investment products. They’re private, agile, complex—and designed to generate absolute returns regardless of what the market is doing.

Let’s break them down.

Hedge Funds: A Different Breed

At their core, hedge funds are private, actively managed pooled investment vehicles. They’re built to exploit inefficiencies, capitalize on market dislocations, and pursue high-risk, high-reward strategies that go far beyond traditional investing.

They were originally named for their use of “hedging” techniques—especially long/short equity positions that reduce exposure to market swings. But today? The term “hedge fund” has evolved into a catch-all for some of the most unconventional strategies in finance.

Key Characteristics of Hedge Funds

Hedge funds don’t follow the same rules as mutual funds or ETFs. Here’s what sets them apart:

- Light Regulation – They avoid the intense scrutiny placed on public funds.

- Flexible Mandates – Hedge funds can invest across asset classes and geographies, often with few restrictions.

- Leverage and Derivatives – Tools like options, futures, and borrowed capital are used aggressively.

- High Fees – The industry standard? A 2% management fee plus 20% of profits—commonly called the “2 and 20” model.

- Exclusive Access – Only accredited or institutional investors can get in.

- Low Transparency – Investors often know less about fund holdings compared to traditional funds.

The Evolution of Hedge Fund Titans

To understand hedge funds, it helps to know the giants:

Citadel

Founded by Ken Griffin in 1990, Citadel is a multi-strategy powerhouse managing ~$63 billion. Griffin famously began trading convertible bonds from his Harvard dorm room. Citadel runs autonomous trading teams across equities, fixed income, commodities, and more. It’s also behind Citadel Securities, one of the world’s largest market makers.

Bridgewater Associates

Ray Dalio started Bridgewater in 1975. The firm now manages ~$125 billion and is known for its macroeconomic bets across countries and asset classes. Dalio’s Pure Alpha strategy is famous for seeking out inefficiencies, while the All Weather portfolio pioneered risk parity. The culture? Radical transparency and principles-based thinking.

Renaissance Technologies

Founded by former codebreaker and math professor Jim Simons, RenTech is the most mysterious of all. Its Medallion Fund—closed to outsiders—has returned an unheard-of ~66% annually (before fees) over 30+ years. RenTech’s edge? Pure mathematics, statistical modeling, and a staff of scientists and engineers rather than traditional finance types.

Hedge Funds vs. Traditional Funds

| Feature | Hedge Funds | Mutual Funds / ETFs |

|---|---|---|

| Strategy | Flexible, unconstrained | Long-only, benchmark-focused |

| Regulation | Light | Heavy |

| Access | Accredited investors only | Open to public |

| Fees | High (2/20) | Low (0.5–1%) |

| Transparency | Low | High |

Why Do Hedge Funds Matter?

So why do institutions still pile into hedge funds despite the high fees and opacity?

- Alpha Generation – Hedge funds pursue absolute returns, meaning they aim to make money in both up and down markets.

- Diversification – Their returns often have low correlation with stocks and bonds.

- Agility – Hedge funds can shift tactics quickly, exploit niche opportunities, and short overvalued assets.

Put simply: they’re designed to find edges in places other investors don’t—or can’t—look.

Interested in Learning About Other Hedge Fund Strategies?

Who Invests in Hedge Funds?

Not just anyone. Because of the risks and complexity, hedge funds are not open to retail investors. Instead, they attract:

- Pension Funds

- University Endowments

- Sovereign Wealth Funds

- Family Offices

- Ultra-High-Net-Worth Individuals

These investors are willing to trade liquidity and transparency for the chance at differentiated returns.

Common Hedge Fund Strategies

While hedge funds began with simple equity hedging, today’s strategies span the globe and asset classes:

- Long/Short Equity – Buy undervalued stocks, short overvalued ones.

- Event-Driven – Profit from mergers, bankruptcies, or restructurings.

- Relative Value – Exploit pricing mismatches between similar instruments.

- Global Macro – Bet on interest rates, currencies, and economic shifts.

- Convertible Arbitrage – Trade mispricings between convertible bonds and equities.

- Multi-Strategy – Combine several approaches under one roof.

The unifying theme? Absolute return focus. Hedge funds care more about making money than beating a benchmark.

A Brief History

The first hedge fund? It dates back to 1949, when sociologist-turned-financier Alfred Winslow Jones launched a fund that used long and short stock positions to reduce risk. He charged a 20% performance fee—decades before it became industry standard.

The industry exploded in the 1990s and 2000s, fueled by institutional demand and market volatility. Today, hedge funds manage over $4 trillion globally.

The CFA Connection

The CFA curriculum doesn’t expect you to launch your own hedge fund. But it does expect you to understand:

- Why hedge funds exist

- How they differ from traditional funds

- The risks and potential rewards involved

- The common strategies employed

That means conceptual clarity—not memorization—is your ticket to mastering this section.

Final Thoughts

Hedge funds are often misunderstood. They’re secretive, complex, and controversial—but they remain a vital part of the investment landscape. For CFA candidates, understanding hedge funds is less about replicating their strategies and more about appreciating how they fit into a modern portfolio.

Up next? We’ll explore the operational mechanics of hedge funds—fee structures, legal setup, investor contracts, and more.