Exploring Hedge Fund Investment Forms: Structures, Strategies, and Suitability

The hedge fund world is known for its complexity and flexibility. But behind the wide array of strategies lies an equally important layer: the investment structure itself. How investors access hedge funds (whether directly or indirectly) plays a crucial role in shaping everything from liquidity and control to tax efficiency and transparency.

Understanding hedge fund investment forms isn’t just a matter of legal technicality. It’s a window into how capital moves, how managers operate, and how institutional and sophisticated investors customize their exposure to one of the most exclusive corners of finance.

Direct Investment: Accessing the Core

Direct investment in hedge funds typically takes the form of private partnerships or limited liability companies (LLCs). These are designed for institutional investors, family offices, and ultra-high-net-worth individuals who can meet the capital minimums and governance demands required.

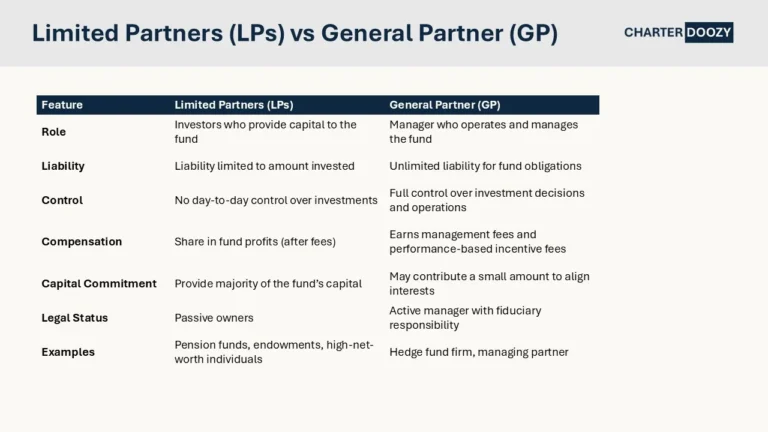

In this model, investors become Limited Partners (LPs), while the hedge fund management firm acts as the General Partner (GP). The GP handles everything from strategy to operations, often charging a flat management fee and a percentage of the profits… the infamous “2 and 20” model.

Direct investment brings both opportunities and risks. On the plus side, these structures are often tax efficient, customizable, and offer exposure to sophisticated, illiquid strategies. On the downside, they come with limited liquidity, limited transparency, and high fees. Due diligence is essential, as is a long-term investment horizon.

Side Letters and Custom Terms

Large institutional investors often negotiate side letters – ie agreements outside the main fund documentation that offer specific concessions. These may include lower fees, enhanced reporting, or unique redemption rights.

While beneficial for the investor receiving them, side letters introduce complexity and create asymmetry among investors.

The Master-Feeder Structure: A Global Gateway

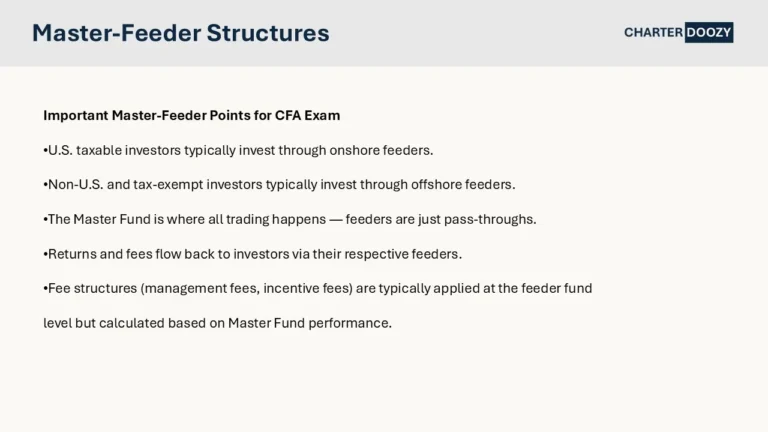

To pool capital from both U.S. and non-U.S. investors while optimizing for tax and regulatory efficiency, many hedge funds use a Master-Feeder structure. Here’s how it works:

- U.S. taxable investors invest through an onshore feeder fund.

- Non-U.S. investors and tax-exempt U.S. entities (like pension funds and endowments) invest through an offshore feeder fund.

- Both feeder funds channel their capital into a master fund, where all trading activity occurs.

This structure allows the hedge fund to operate a single investment portfolio while accommodating investors with different tax profiles.

It’s a powerful tool for scale, operational efficiency, and global fundraising—but also one that adds structural complexity.

Custom Vehicles: Funds of One and Separately Managed Accounts

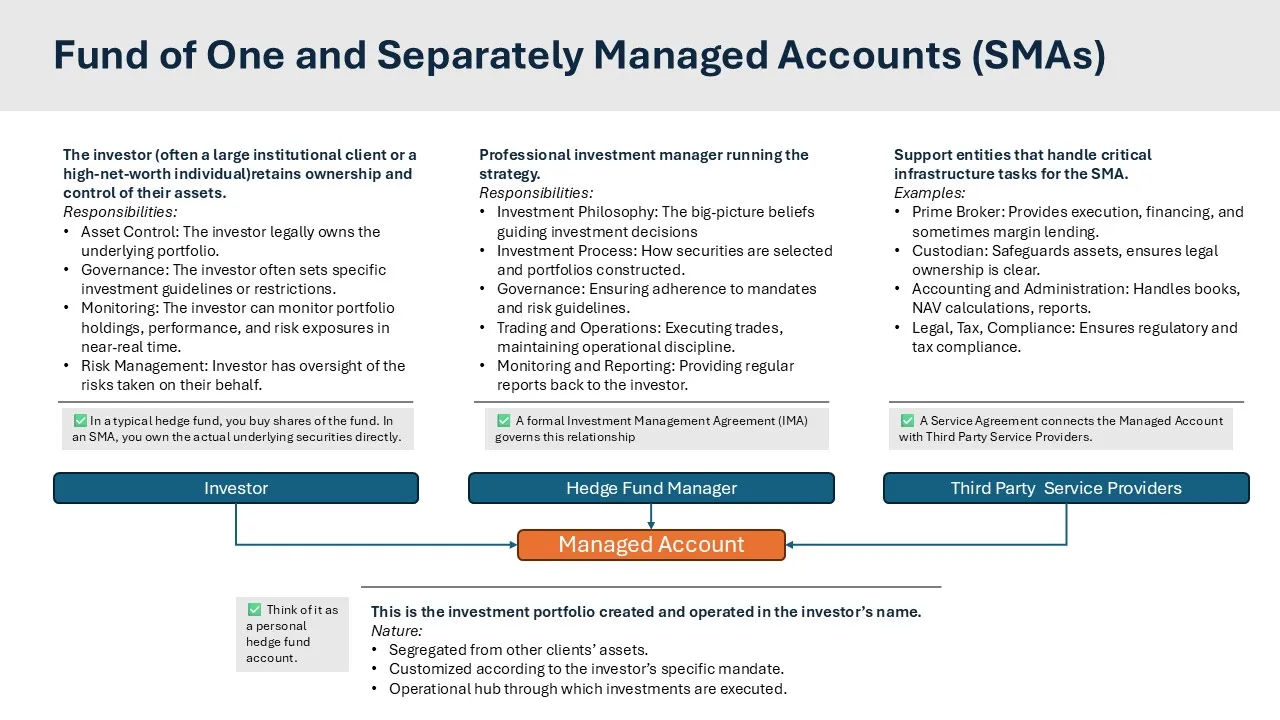

Some investors prefer full customization, which brings us to two lesser-known but growing forms of direct access: Funds of One and Separately Managed Accounts (SMAs).

A Fund of One is a hedge fund built specifically for a single investor. This allows for full alignment of strategy and reporting, though it demands significant resources and legal structuring.

SMAs go a step further. Here, the investor owns the underlying assets directly, while the hedge fund manager simply executes trades on their behalf.

SMAs offer maximum control and transparency (ideal for institutions with strict oversight requirements) but come with a heavier governance burden and higher operational costs.

Indirect Investment: Broader Access, Lower Commitment

For investors who can’t or don’t want to invest directly, several indirect forms provide access to hedge fund strategies in a more accessible, liquid, and transparent format.

Funds of Hedge Funds (FoFs)

One of the most traditional routes is through a Fund of Hedge Funds. These vehicles pool investor capital and allocate it across a diversified set of hedge fund managers and strategies.

FoFs offer benefits like diversification, professional due diligence, and access to otherwise closed hedge funds. They also allow smaller institutions and high-net-worth individuals to gain exposure with lower minimums than direct investment would require.

The trade-off? Cost. FoFs come with an extra layer of fees on top of those charged by the underlying hedge funds. This “fee layering” can meaningfully reduce net returns, which has led to criticism, especially in periods of underperformance.

Hedge Fund Replication Products

Another innovation in the space is hedge fund replication, often delivered through exchange-traded funds (ETFs) or structured products. These aim to mimic the return patterns of certain hedge fund strategies using publicly traded securities and quantitative models.

While replication products offer higher liquidity, lower fees, and greater transparency, they also have limitations. They struggle to capture the nuances of illiquid or event-driven strategies and can exhibit tracking error during market dislocations. Still, for investors seeking hedge fund-like behavior without the complexity or cost, replication ETFs are gaining popularity.

Liquidity, Control, and Transparency: Comparing the Forms

The choice between direct and indirect hedge fund investment forms depends heavily on the investor’s needs around liquidity, control, minimum investment, and transparency.

Direct vehicles like Limited Partnerships or Master-Feeder funds are low in liquidity and transparency but offer direct exposure to sophisticated strategies. SMAs and Funds of One provide more control and insight but require higher investment thresholds and operational oversight.

Indirect forms like FoFs and ETFs are much more liquid and transparent, with lower minimums, but they lack the customization and raw exposure of direct vehicles.

Interested in Learning About Other Hedge Fund Strategies?

Final Thoughts

Hedge fund strategies may dominate headlines, but the real engine behind investor experience lies in the structure of the investment itself.

Whether through a tightly negotiated Fund of One or a low-cost replication ETF, the form determines how capital is deployed, how risks are managed, and how returns are realized.

As hedge funds continue to evolve, so too will the tools and structures used to access them.

For the sophisticated investor, mastering the architecture is as important as understanding the strategy.

Because in the world of hedge funds, how you invest can matter as much as what you invest in.